En résumé : Idées clés Détails 🦄 Signification de la licorne Symbole de pureté et magie, inspire histoires et légendes. 👧 Moment magique Une fille choisit de colorier "Lara, la licorne magique". 🎨 Choix de coloriages Options variées comme Licorne Kawaii et...

Bienvenue sur Coloriages-gratuits

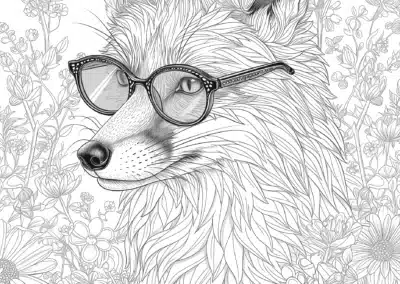

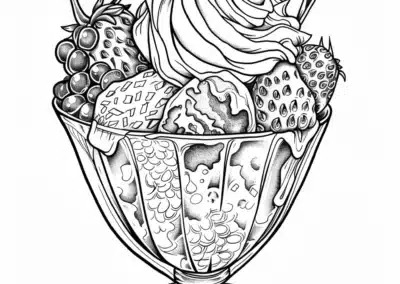

Ici, petits et grands découvrent une collection magique de dessins uniques, prêts à prendre vie sous vos crayons de couleur. De la nature éblouissante aux personnages féeriques, en passant par les motifs géométriques apaisants, notre bibliothèque regorge de trésors à explorer. Chaque page est une invitation à exprimer votre art, à détendre votre esprit et à partager des moments de qualité en famille. Préparez vos crayons, choisissez votre dessin préféré et plongez dans un monde où les couleurs n’ont pas de limites. Bienvenue dans votre espace de créativité sans fin !

Jennifer Larcher, créatrice du site

Je m’appelle Jennifer, et depuis toujours, le coloriage occupe une place spéciale dans mon cœur. C’est une passion qui m’a accompagnée depuis mon enfance, me permettant de m’évader, de me concentrer et de partager des moments précieux avec mes proches. Avec l’envie de transmettre cette passion, j’ai créé un site dédié aux coloriages, un espace où chacun, petit ou grand, peut découvrir le bonheur de créer et d’exprimer sa créativité.

Tous les coloriages

Un merci inoubliable : ces modèles de coloriage gratuits feront fondre votre enseignante !

En résumé : Idée clé Détails 🎨 Expression artistique Utiliser le coloriage comme moyen personnel et créatif de remerciement. ✏️ Choix du modèle Trouver et personnaliser des modèles gratuits qui reflètent vos sentiments. 🖌️ Techniques variées Expérimenter avec crayons,...

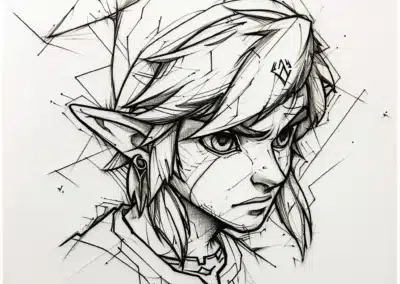

Devenez un maître du coloriage Zelda : techniques secrètes révélées !

En résumé : Point clé Détails 🎮 Univers de Zelda Une aventure épique qui traverse les âges, captivant joueurs avec histoires et personnages. 🖌️ Coloriage Zelda Offre une toile vierge pour réimaginer Hyrule, avec des astuces pour donner vie à ses personnages. 👑...

Votre enfant adore les voitures ? Ces coloriages Lamborghini gratuits vont l’émerveiller !

En résumé : Idée principale Détails 🎨 Passion pour la couleur Utiliser les crayons de couleur pour transformer les dessins en noir et blanc. 🚗 Attrait des Lamborghinis Les enfants sont fascinés par le coloriage des Lamborghinis, machines exotiques. 🖍 Avantages...

Fan de Mario ? Découvrez 10 dessins de Bowser à imprimer gratuitement !

En résumé : Ideas principales Détails 🎨 Coloriage captivant Explorer la complexité de Bowser et son design via le coloriage. 💡 Astuce de pro Mixer les teintes pour des yeux flamboyants et un effet vibratoire. 🖼️ Arrière-plan Ajouter des éléments comme un château ou un...

Vos enfants vont adorer : dessins Pat Patrouille gratuits à imprimer !

En résumé : Thème Description 🎨 Passion couleur Partager le plaisir du coloriage et du dessin avec une touche personnelle. 🐾 Pat' Patrouille Découvrir les chiots super-héros à travers le coloriage. 🖌 Techniques créatives Utiliser des teintes audacieuses pour exprimer...

L’essor des livres de coloriage pour adultes comme réflexion sur l’actualité mondiale

Depuis quelques années, les rayons des librairies et boutiques en ligne connaissent un phénomène grandissant : la popularité des livres de coloriage pour adultes. Ces ouvrages, loin d'être de simples passe-temps, sont devenus un véritable miroir de notre société et de...

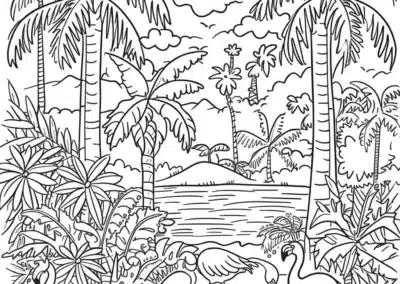

Évasion garantie : ces coloriages de paysage vont transformer votre stress en plaisir !

En résumé : Idées clés Détails 🎨 Aventure artistique Explorer la créativité en coloriant des paysages naturels ou urbains. 🖌 Thèmes variés Choisir entre calme de la campagne, dynamisme urbain, fantaisie de jardins ou exotisme africain. 📚 Apprentissage Développer la...

Vous ignoriez ces effets incroyables du coloriage sur votre cerveau !

En résumé : idées clés détails 🌳 Beauté naturelle Source d'inspiration et de bien-être mental. 🎨 Créativité artistique Utiliser le coloriage pour explorer le monde naturel. 👦 Éducation des enfants Stimuler imagination et concentration par le coloriage. 🌿 Connexion...

Faites une pause méditative avec des mandalas à colorier

Le monde moderne est souvent rythmé par le stress et la course contre la montre. Pour se détendre et se recentrer, les mandalas à colorier représentent une solution idéale pour allier créativité, méditation et relaxation. Dans cet article, découvrez ce qu'est un...

Les meilleurs crayons et feutres pour un coloriage réussi

Chez les amateurs d’art comme chez les novices, le coloriage est une activité relaxante et créative qui permet de se détendre tout en réalisant de belles œuvres. Pour rendre cette expérience encore plus plaisante, il est essentiel de choisir des outils adaptés à ses...

Maîtriser l’art du coloriage : techniques, textures et mélanges de couleurs

Le coloriage est un véritable art qui requiert de la créativité, de la technique et de la patience. En améliorant vos compétences en matière de coloriage, vous pouvez créer des œuvres d’art magnifiques et réalistes. Dans cet article, nous allons explorer les...

Revivez la féerie de Disney avec des coloriages sur le thème de Cendrillon

L'univers magique des contes de fées n'a cessé d'enchanter les enfants comme les adultes à travers les années. Parmi ces histoires, celle de Cendrillon, adaptée en un célèbre dessin animé par Disney, continue de charmer les petits et les grands. Pour raviver cette...

Créez votre propre page de coloriage : outils, choix du thème et techniques de dessin

Dans cet article, nous allons vous présenter les étapes pour créer votre propre page de coloriage. Vous découvrirez les outils pour dessiner, comment choisir un thème adapté et les différentes techniques de dessin à employer. Les outils indispensables pour dessiner...

Les tendances du coloriage en 2024 : styles, couleurs et artistes

Dans le monde de l’art, le coloriage est une pratique populaire qui se renouvelle et évolue sans cesse. En 2024, les tendances du coloriage sont marquées par des styles éclectiques, des couleurs vives et des artistes inspirants. Les styles de coloriage...

Devenez un héros du dessin avec les coloriages de la Pat’ Patrouille

Vous cherchez une activité ludique et créative pour vos enfants ? Le coloriage est un excellent moyen pour encourager leur imagination et leur créativité. Les personnages de la célèbre série animée, la Pat' Patrouille sont particulièrement appréciés par les plus...

Comment le coloriage favorise la relaxation et la réduction du stress ?

De nos jours, le stress est un probléme commun pour bon nombre de personnes. Avec le rythme effréné de la vie moderne, il est important de trouver des moyens efficaces pour se détendre et évacuer le stress accumulé. L’un de ces moyens est le coloriage, une...

Téléchargez et coloriez vos personnages préférés de Peppa Pig pour des moments créatifs

Les fans du dessin animé Peppa Pig sont nombreux, petits et grands. Quoi de mieux que d'allier divertissement et créativité en téléchargeant et coloriant ces adorables cochons ? Découvrez ici les principaux personnages de cette famille attachante, les ressources à...

Le monde enchanté des coloriages de flamants roses

Dans la vaste collection de coloriages de flamants roses disponibles sur internet, il existe une multitude d’options pour les amateurs d’art et de nature. Que vous aimiez dessiner ou simplement ajouter votre touche personnelle à un dessin préexistant, les ressources...

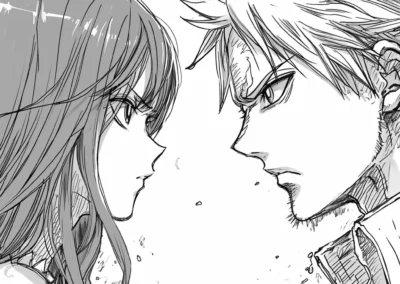

Le monde fascinant du dessin ado

Le dessin ado est une forme d’art qui permet aux jeunes de s’exprimer et de communiquer leurs émotions, leurs idées ou leur créativité. Il englobe différents aspects artistiques tels que le tableau, les idées et thèmes. Cet article explore l’univers du dessin...

Plongez dans l’univers des ninjas avec les coloriages Naruto Kyubi

Les fans de manga et d’anime connaissent bien le nom de Naruto Uzumaki, le jeune ninja aux mille et un exploits. Grâce à son tempérament indomptable et sa volonté de fer, Naruto est parvenu à réaliser bon nombre de prouesses épiques au fil de ses aventures. Ce qui...

Les joies du coloriage de Pâques : une tradition amusante et créative

Le coloriage de Pâques, ou coloriage paques en français, est un passe-temps indémodable pour les enfants (et même pour les adultes !) durant cette période festive. Entre dessins de lapins, d'œufs décorés, de cloches et de poussins, il y en a pour tous les goûts et...

Le monde sous-marin d’Ariel à travers les dessins

Venez plonger dans l'univers enchanteur des dessins Ariel, la célèbre petite sirène de Disney qui a conquis le cœur de millions de personnes à travers le monde. À travers cet article, nous vous invitons à découvrir le tableau fascinant des créations artistiques autour...

Plongez dans l’univers fascinant de dessin Kirby : voici le meilleur coloriage

Dans le domaine du jeu vidéo, un personnage a su se démarquer au gré des années : il s’agit de Kirby. Ce petit être rose et rond fait régulièrement l’objet de différents projets artistiques tels que les coloriages, les dessins et autres illustrations pour enfants....

Découvrez le dessin à colorier kawaii que votre enfant va adorer

Dans cet article, nous allons explorer l’univers enchanteur du dessin à colorier kawaii. Prêt(e)s à plonger dans un monde de couleurs pastel et de personnages adorables ? Suivez-nous pour découvrir les origines et la popularité croissante de cette tendance issue du...

Les dessins célèbres qui ont marqué l’histoire de l’art

L'histoire de l'art est riche en œuvres d'exception qui continuent d'inspirer les artistes et le public du monde entier. Les dessins, en particulier, offrent un aperçu unique sur la pensée créative des artistes et permettent d'étudier leur technique avec une grande...

Maîtriser les techniques de coloriage pour un rendu artistique

Le coloriage est bien plus qu'un simple passe-temps destiné aux enfants. En effet, cette activité connaît un véritable engouement auprès des adultes qui y voient une source de détente et de créativité. Pourtant, il ne suffit pas d'appliquer de la couleur sur une...

Apprendre à dessiner des sujets mignons et faciles pour les enfants

Le dessin mignon facile est un excellent moyen de favoriser la créativité et l'amusement chez les enfants. Qu'il s'agisse d'animaux, de personnages ou de décors fantaisistes, aborder ces sujets simples mais attrayants leur permettra d'explorer leur imagination. Dans...

Coloriage Pyjamasque à imprimer : une activité amusante et éducative pour les enfants

Les coloriages Pyjamasques à imprimer sont de plus en plus populaires auprès des parents qui cherchent des activités créatives et éducatives pour leurs enfants. Inspirés de la célèbre série animée, ces dessins proposent aux petits de donner vie à leurs héros préférés...

Dracaufeu coloriage : un univers créatif et passionnant

Le dracaufeu coloriage est une activité divertissante qui permet de stimuler la créativité et l'imagination des personnes de tous âges. Mais avant de plonger dans le monde mystérieux du dracaufeu, il serait judicieux de comprendre ce qu'est ce concept. Qu'est-ce que...

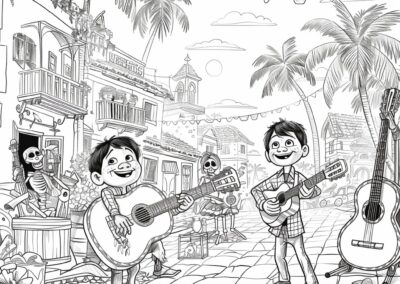

Le monde merveilleux des coloriages à imprimer

Les coloriages à imprimer (Noël, Halloween, Kawaii, Disney, films) sont un véritable phénomène, autant pour les enfants que pour les adultes. Il existe aujourd’hui une multitude de sites et d’ouvrages proposant des milliers de dessins à colorier sur tous les thèmes possibles et imaginables. Que vous soyez fan de dessins animés, d’animaux, de personnages célèbres ou encore d’objets du quotidien, vous trouverez forcément le coloriage qui vous correspond.

Nous avons conçu nous-même la collection avec des animaux à colorier, un dessin avec un héros ou encore des versions pour Pâques et même des mandalas. Retrouvez les thèmes qui vous combleront de bonheur que vous aimiez les licornes, les fleurs ou la fête.

Nous vous proposons même un cahier de coloriages qu’il est possible d’acheter directement sur Amazon. Il fera le bonheur de votre enfant ou de l’un de vos proches.

Pourquoi choisir les coloriages à imprimer pour vos enfants ?

Les avantages du coloriage à imprimer sont nombreux : il est pratique, économique et permet de développer sa créativité en coloriant sans aucune contrainte. Ce dessin comble un enfant, il pourra alors s’occuper gratuitement.

- Vous choisissez le motif souhaité (Disney, mandala, licorne, kawaii, Noël, Halloween…) parmi une vaste sélection de dessins disponibles sur notre site Coloriages gratuits.

- Vous travaillez avec différents outils, tels que les crayons de couleur, feutres, pastels, aquarelles ou peintures acryliques, selon les préférences et le niveau de compétence de chacun.

- Vous apprenez à maîtriser différentes techniques de coloration et appliquez votre propre style artistique, tout en se détendant et en profitant d’une activité amusante.

- Les bienfaits sur la santé mentale : en se focalisant sur les détails, les formes et les couleurs des dessins, l’esprit s’évade et le stress du quotidien s’atténue. Cela permet également de développer sa concentration et sa patience.

Des coloriages pour les enfants

Le coloriage à imprimer est particulièrement apprécié des plus jeunes. Les enfants adorent passer du temps à colorier leurs personnages préférés, une licorne, des héros Disney alors que les mandalas sont aimés par les adultes, ce qui leur permet d’apprendre tout en s’amusant. En effet, le coloriage contribue au développement de la motricité fine, de la coordination œil-main et de la créativité chez l’enfant.

Et même des coloriages pour les adultes

Le coloriage n’est pas réservé aux enfants ! De plus en plus d’adultes ont recours à ces activités pour se détendre après une longue journée de travail ou simplement pour occuper leur temps libre de manière ludique. Le succès grandissant des livres de coloriage destinés aux adultes témoigne de cet engouement. Sur notre site Coloriage Gratuits, le dessin est gratuit ! Vous le téléchargez et vous le colorier.

Comment choisir son coloriage à imprimer avec cette collection ?

Avec un tel choix de dessins disponibles (Pokemon, fêtes, automne…), il peut être difficile de trouver le coloriage idéal.

- Optez pour un thème qui vous plaît (Noël, Pâques, Halloween, nature, mandala, licornes), qu’il s’agisse de personnages fictifs, d’animaux, de fleurs, de monuments célèbres ou encore de motifs abstraits.

- Privilégiez notre site puisqu’il y a des coloriages de qualité, avec des motifs bien dessinés et des contours nets.

- Choisissez un niveau de difficulté adapté à vos compétences et à votre patience : certains coloriages sont très simples, tandis que d’autres comportent de nombreux détails qui requièrent une grande minutie.

Une astuce pour dénicher le coloriage idéal

Pour trouver rapidement le dessin parfait à imprimer, n’hésitez pas à effectuer une recherche sur notre site avec des mots-clés spécifiques, tels que « coloriage à imprimer animaux », « coloriage à imprimer super-héros » ou encore « coloriage à imprimer fleurs ». Vous accéderez ainsi directement à des sélections de coloriages correspondant à vos critères dans notre collection. Inutile de vous rendre sur Pinterest.

Quelques conseils pratiques pour réussir ses coloriages à imprimer

Vous avez trouvé le motif idéal et vous êtes impatient de commencer ? Voici quelques astuces pour profiter pleinement de cette activité, c’est même un art !

Imprimez votre dessin sur un papier adapté à votre technique de coloration. Par exemple, un papier épais et grainé sera recommandé si vous travaillez aux crayons de couleur, tandis qu’un papier plus lisse conviendra mieux pour l’utilisation de feutres ou de peinture.

Prenez le temps de bien choisir vos outils de coloration, en tenant compte de leur qualité, de la variété des couleurs proposées et de leur maniabilité. Un ensemble de crayons de couleurs de bonne qualité permettra par exemple de varier les effets et d’obtenir un résultat harmonieux et vibrant.

Pour obtenir de jolies nuances et dégradés, travaillez par couches successives et mélangez subtilement les couleurs entre elles. Il est important de maintenir une certaine cohérence dans l’intensité des teintes afin de créer un ensemble équilibré et agréable à l’œil.

Se détendre et prendre le temps grâce aux coloriages

Surtout, n’oubliez pas que le but premier du coloriage à imprimer est de se détendre et de passer un bon moment. Ne vous souciez donc pas du temps que vous passerez sur votre œuvre, et prenez plaisir à laisser libre cours à votre créativité ! Une page peut être utilisée pendant plusieurs jours, c’est un art qui demande de la patience.

Des idées pour valoriser vos coloriages à imprimer

Une fois achevé, votre coloriage peut devenir un véritable objet décoratif ou un cadeau unique et personnalisé. Vous l’aurez eu gratuitement grâce à notre site ! Vous pourrez même partager le résultat de votre art sur Pinterest.

Encadrez vos plus belles créations et accrochez-les au mur pour ajouter une touche d’originalité à votre intérieur.

Confectionnez des cartes de vœux ou des invitations en utilisant vos coloriages comme motif.

Offrez vos réalisations à vos proches comme signe d’amitié ou de soutien : un coloriage soigneusement choisi et colorié avec amour constitue un présent à la fois personnel et chargé d’émotions.

Le coloriage à imprimer est une activité incontournable pour tous les artistes en herbe et les adeptes de la détente créative. N’hésitez pas à explorer cet univers riche en couleurs et en émotions, et laissez-vous surprendre par ses innombrables possibilités. Une page peut rapidement se transformer. Testez dès maintenant ces activités que vous soyez un fan de princesses, de Pokemon ou encore de fête.

Inutile d’acheter un cahier à thème, tout est à votre disposition sur notre site Coloriages gratuits. Nous vous proposons même d’apprendre quelques techniques magiques. Nous disposons d’une catégorie dédiée à toutes les astuces. Ce sont des activités à réaliser, vous pourrez ensuite réaliser des coloriages pour la nature, Pâques, les princesses, les films, le chat, le mandala…

N’hésitez pas à mettre en place ces jeux avec les coloriages de votre choix. Vous pourrez même dénicher des thèmes en fonction des saisons avec l’automne, l’été, l’hiver et le printemps. A l’occasion de l’approche des fêtes de fin d’année, il est toujours réjouissant de mettre en place des jeux avec des coloriages magiques.

Retrouvez dès maintenant nos différentes catégories avec les animaux comme le chat pour booster votre créativité. Vous délaisserez ainsi la publicité, le streaming et la télévision afin de prendre soin de votre bien-être.